capital gains tax increase date

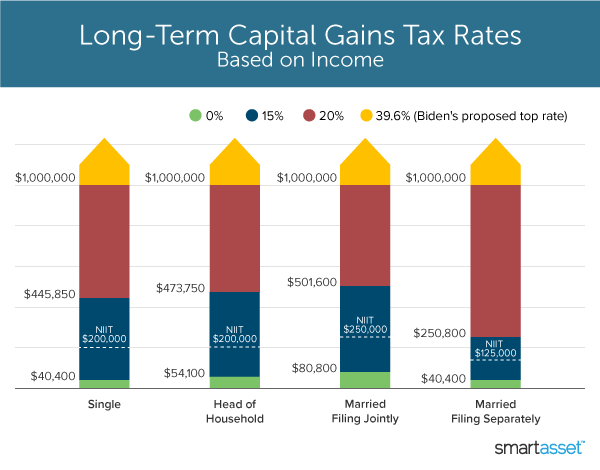

Understanding Capital Gains and the Biden Tax Plan. In 2021 the higher 288 long-term capital gains rate will be applied 3 to single taxpayers whose adjusted gross income exceeds 523601 and 628301 for taxpayers filing married filing.

In Case Of Capital Gains Tax Hike Don T Panic Thinkadvisor

This will affect long-term.

. You also do not have to pay Capital Gains Tax if all your gains in a year are under your tax-free allowance. Capital gains taxes on assets held for a year or less correspond to ordinary income tax. Long-term capital gains are from an asset youve held for more than one.

The amount you owe in capital gains taxes depends in part on how long you owned the asset. This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28. Additionally the proposal.

Key Points House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means. President Biden has proposed raising long-term capital gains taxes for individuals earning 1 million or more to 396. If your taxable income is less than 80000 some or all of your net gain may even.

Currently the capital gains rate is 20 for single taxpayers with income over 441451 and for taxpayers who are married filing jointly with income over 496601. President Joe Biden proposed a 396 top tax rate on capital gains and dividends for millionaires when he released his fiscal 2022 budget request to Congress on Friday. Added to the existing 38 investment surtax on higher.

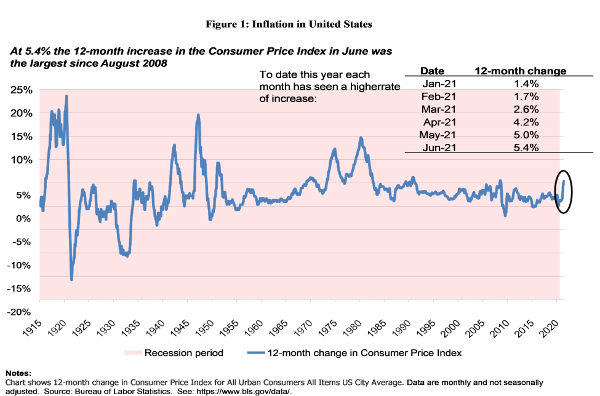

The effective date for this increase would be September 13 2021. Capital Gains Tax Rates for 2021 The capital gains tax on most net gains is no more than 15 for most people. Top Combined Capital Gains Tax Rates Would Average 48 Percent Under Bidens Tax Plan April 23 2021 Garrett Watson Erica York President Joe Bidens American Families.

Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. The gains that you make from the selling of your capital assets which you held for at least one year will be considered long-term gains and these can be taxed at anything from.

Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill and the potential effective date is critical for many investment. If you sold a UK residential property on or after 6 April 2020 and you have tax on.

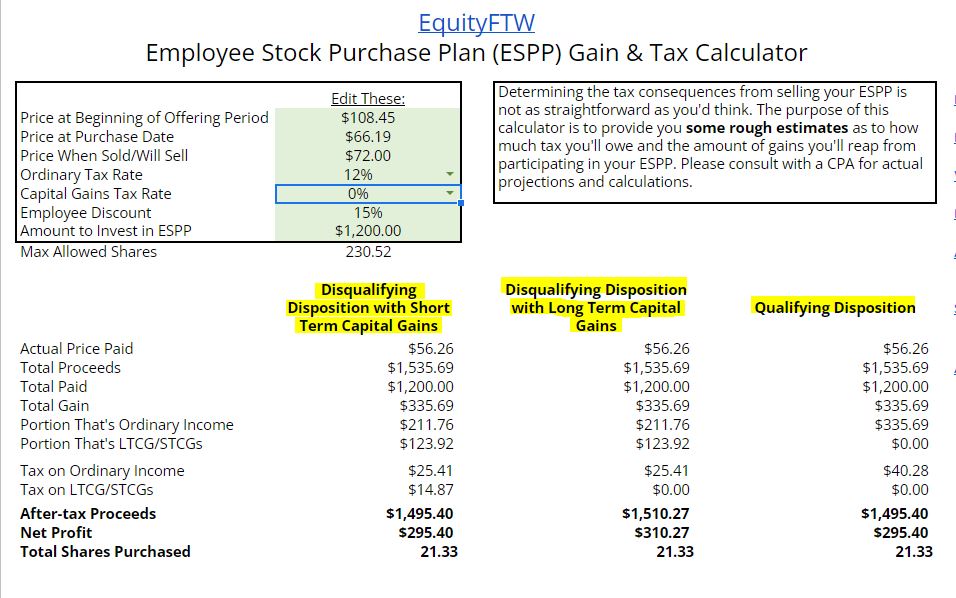

Help In Understanding Espp And Stcg Ltcg Qualifying Bogleheads Org

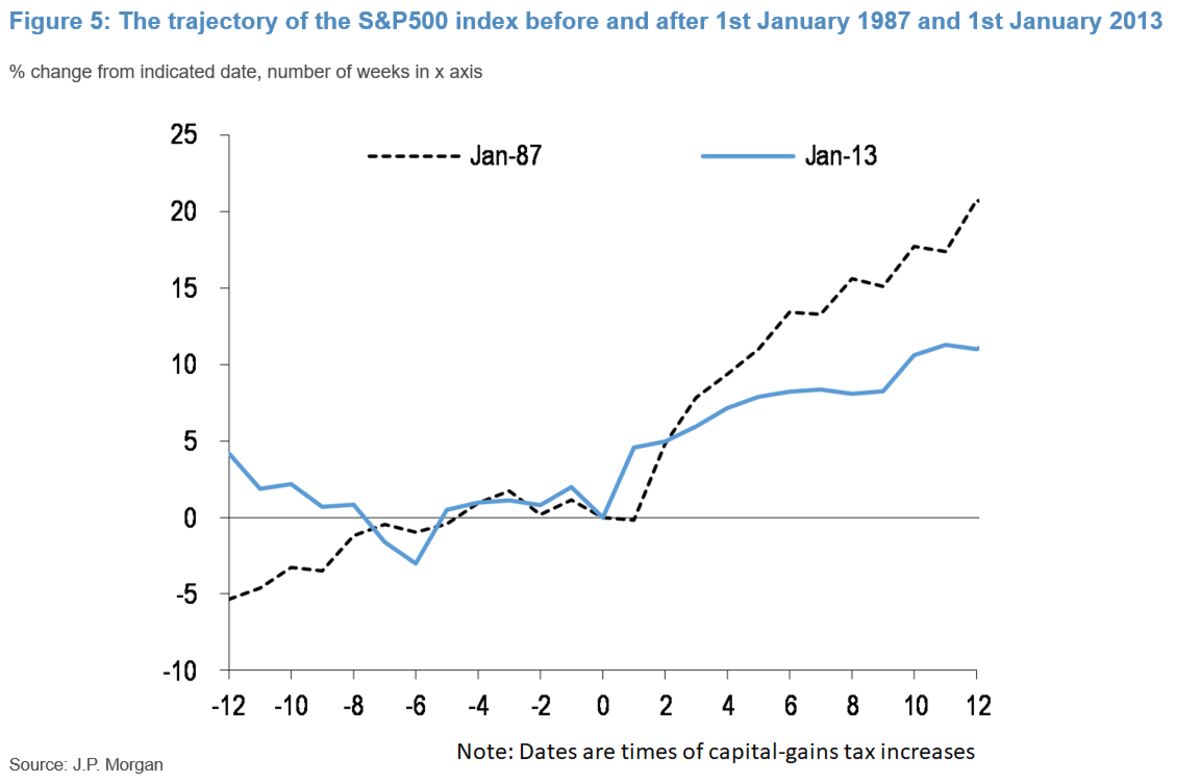

Jpmorgan Says U S Capital Gains Tax Hike May Briefly Hit Stocks Bnn Bloomberg

Democrats Propose Higher 25 Capital Gains Tax Rate Here Are 3 Ways To Minimize The Potential Hit Bankrate

The Capital Gains Dilemma Northern Trust

How Will A Capital Gains Tax Hike Affect Red Hot Ria M A Market Investmentnews

Ways And Means Chairman Neal Announces Reconciliation Tax Increase Proposals Pwc

The Economic Effects Of Proposed Changes To The Tax Treatment Of Capital Gains

Capital Gains Taxes Are Going Up

Biden Capital Gains Tax Rate Would Be Highest In Oecd

Taxing Capital Gains At Ordinary Rates Evidence Says Do It So Does Buffett Jared Bernstein On The Economy

What S In Biden S Capital Gains Tax Plan Smartasset

Calculate Your Capital Gains Tax In 5 Easy Steps

An Overview Of Capital Gains Taxes Tax Foundation

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

White House Considers Capital Gains Tax Cut Neutral Cost Recovery

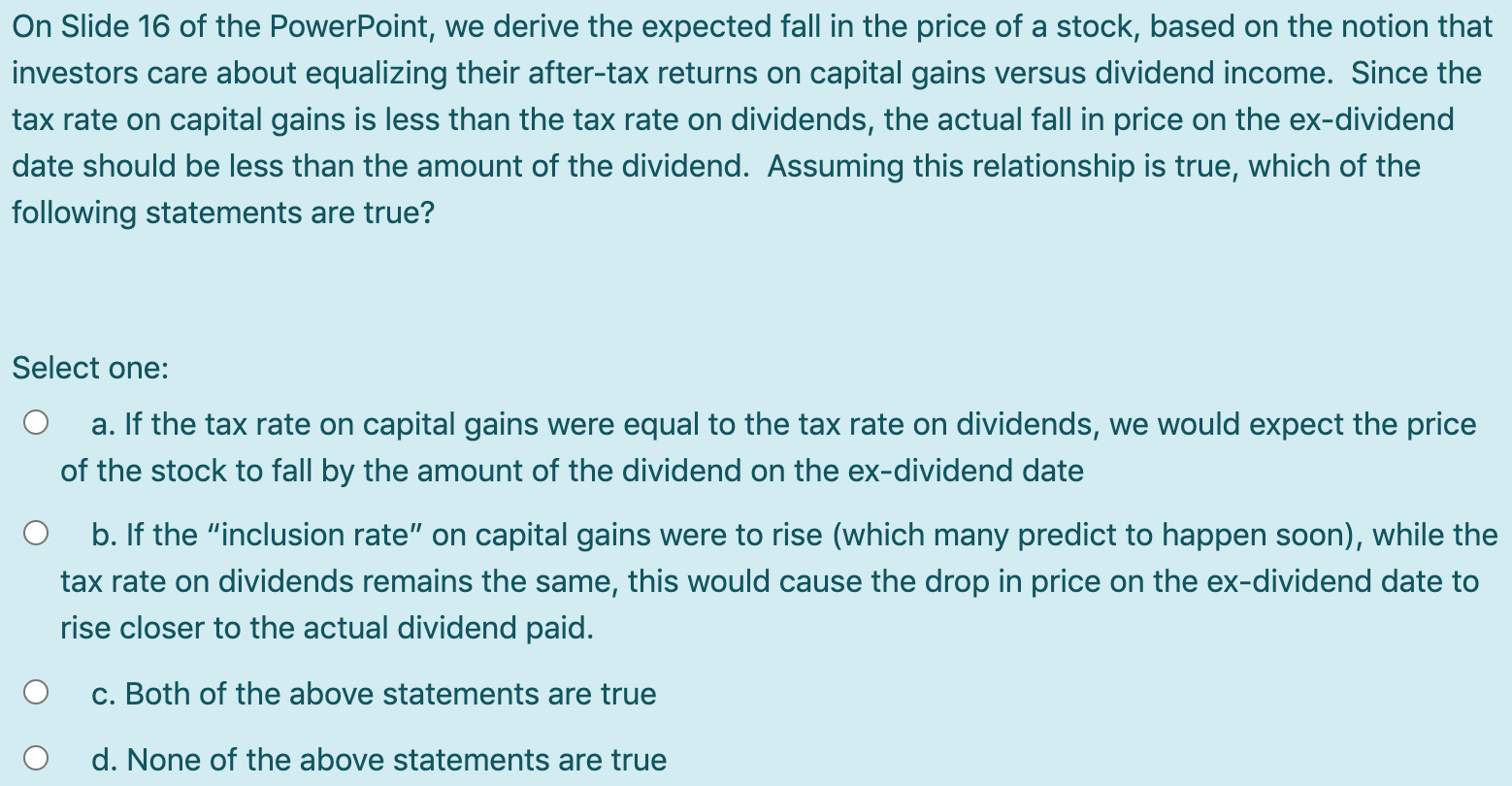

Solved On Slide 16 Of The Powerpoint We Derive The Expected Chegg Com

A Capital Gains Tax Hike Should Alter Your Income And Selling Strategy

If Democrats Win In November Brief Hit To Stocks Equities Jpmorgan Says Bloomberg

The Tax Plan Tees Up 20 Yearly Gains From Reits Forever Nasdaq